9 Portfolios For Strategic Income With One Clear Winner

9 Portfolios For Strategic Income With One Clear Winner

Strategic income investors and portfolio managers typically aim to maximize current income using a mix of high-yield, international, government, and emerging market bonds. Some managers may add futures, options, and swaps to their portfolio.

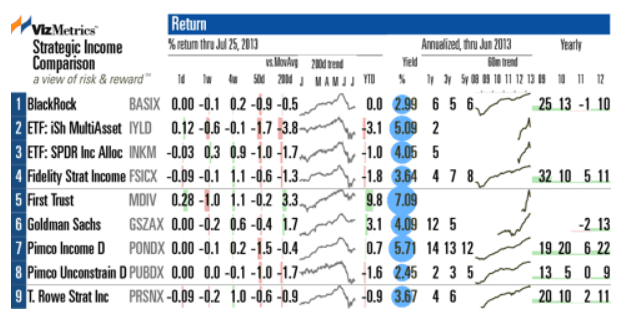

We examined several strategic income portfolios to see which have been the most successful. We chose a variety of strategic income funds and applied a risk vs. return analysis to see which have done the best on a risk-adjusted basis. These funds typically have "dynamic," "multi-asset," "strategic," or "unconstrained" in their name.

Returns of Selected Strategic Income Portfolios

Looking at the nine portfolios, we see quite different annual yields (ranging from 2.45% to 7.09%) which reminds us of the diversity of strategies at play here.

Risk-Adjusted Returns

The four funds with at least five years of history have significant positive alpha and risk-adjusted returns. Below are the five-year results on an annualized basis.

- BlackRock Strategic Income Opportunities (MUTF:BASIX): Total Return 5.5%, Alpha 4.9%, Risk-adjusted return 16.2%

- Fidelity Strategic Income (MUTF:FSICX): Total Return 7.7%, Alpha 6.9%, Risk-adjusted return 18.1%

- Pimco Income D (MUTF:PONDX): Total Return 12.4%, Alpha 11.9%, Risk-adjusted return 43.6%

- Pimco Unconstrained Bond D (MUTF:PUBDX): Total Return 5.3%, Alpha 5.0%, Risk-adjusted return 35.9%

Maximum Drawdown

The 5-year maximum drawdown for the these portfolios has ranged from -16.6% to -2.5%, which compares favorably to other "non-strategic" income portfolios. For example, Vanguard Target Retirement Income (MUTF:VTINX) had a drawdown of -15.2% over the same period, but with a lower risk-adjusted return than all of the four portfolios above. VTINX returned 5.4% with alpha of 4.6% and risk-adjusted return of 13.6%.

To see a graphical view of maximum drawdown, alpha, and risk-adjusted return for these portfolios, visit Strategic Income Portfolios: Risk vs. Return Metrics.

Mitigating Interest Rate Risk

When interest rates rise, bond values will drop, but these funds have flexibility due to the wide variety of securities they can own. This should help mitigate the effects of a rising rate. For example, these portfolios can reallocate using bonds of varying maturities, inflation-indexed securities, selected high-yield investments, distressed debt, and emerging market debt-- all of which could provide some insulation from interest rate risk.

Conclusion

A strategic income approach, as used by the portfolios in this analysis, can produce solid risk-adjusted returns. Pimco Income D (PONDX) emerges as the clear winner and is worth a closer look since it has posted strong total returns as well as significant risk-adjusted returns. While we all know that the past doesn't guarantee the future, this strategic income portfolio stands out among this batch. For eligible purchasers, administrative (MUTF:PIINX) and institutional (MUTF:PIMIX) share classes are also available with lower operating expenses.

as published on

Disclosure: I am/we are long EFA, IWM, GLD, TLT, QQQ, SPY, EEM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.